sca smart card We’ll discuss what it is, the history of SCA, how it works, and why it’s important. To start, let’s . The ACR1252U-A1 is a USB smart card reader developed based on 13.56MHz contactless technology. It is one of the first devices in the industry to receive NFC Forum Certification, which proves that the ACR1252U-A1 is interoperable with .SDK. The ACR1552U USB NFC Reader IV is a CCID & PC/SC compliant smart card reader, developed based on 13.56MHz contactless technology. This plug-and-play NFC reader is equipped with a high-speed communication capability .

0 · what is strong customer authentication

1 · what does sca mean in credit card

2 · what does sca mean in banking

3 · strong customer authentication sca

4 · strong customer authentication guidelines

5 · sca card payments

6 · mastercard sca sign in

7 · credit card scam

uNFC - NFC library for .Net platforms. uNFC library allow to use NFC integrated circuit connected to your PC (via serial) or to embedded system based on Windows Embedded Compact or .Net .

Strong Customer Authentication (SCA) is required for certain online payment .We’ll discuss what it is, the history of SCA, how it works, and why it’s important. To start, let’s .

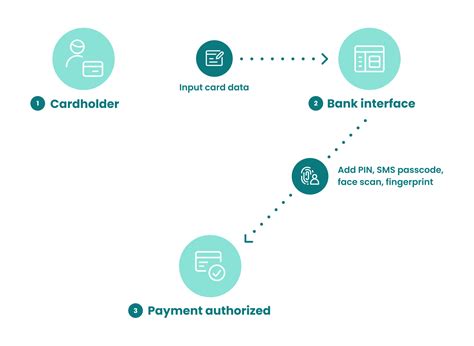

Strong Customer Authentication (SCA) is required for certain online payment transactions within the European Economic Area (EEA). It aims to enhance the security of electronic payments by requiring customers to provide two or more authentication factors. Here are some key instances when SCA is typically required:This SCA guide covers the strong customer authentication definition, its benefits up-to-date exemptions, and the best implementation solutions.We’ll discuss what it is, the history of SCA, how it works, and why it’s important. To start, let’s define SCA. What are the SCA requirements? SCA is a set of payments industry regulatory requirements that seek to help secure online and mobile payments and reduce fraud.Utilizes unique encryption keys for authentication and digital signatures, available through Thales USB tokens and smart cards. Learn More

what is strong customer authentication

Strong Customer Authentication (SCA) was initiated to increase the security of electronic payments through requiring customers to provide two forms of identification when shopping online: Before SCA, payments were authorized using only .Strong Customer Authentication (SCA) is a mandate introduced by the Payment Services Directive (PSD2) enacted by the European Commission, which requires electronic payments initiated by the buyer to be authenticated by at least two of the following three factors. Something the cardholder knows (e.g., a password or PIN) Something the cardholder .What is Strong Customer Authentication (SCA)? Strong Customer Authentication is a set of upcoming regulatory requirements, designed to make paying online more secure and, consequently, reduce payment fraud. SCA adds an extra layer of security when end-customers make a payment online.

Strong customer authentication, or SCA, is a European regulation designed to slash payment fraud rates and bolster the security of contactless and online transactions. It affects everything from Google Pay to credit card transactions to contactless at the till. SCA is tucked into the European Union’s revised Payment Services Directive (PSD2). This includes the introduction of strong customer authentication (SCA) requirements, which are now enforced throughout the EU and the UK. Below, we’ll cover strong customer authentication, the SCA requirements set out in PSD2, and what to expect from new legislation PSD3 and PSR1. SCA is a requirement outlined in the PSD2 to make electronic payments safer. It’s a process designed to authenticate the user’s identity as part of the payment transaction. In other words, SCA requires that customers prove their identity before proceeding with online payment. Strong Customer Authentication (SCA) is required for certain online payment transactions within the European Economic Area (EEA). It aims to enhance the security of electronic payments by requiring customers to provide two or more authentication factors. Here are some key instances when SCA is typically required:

This SCA guide covers the strong customer authentication definition, its benefits up-to-date exemptions, and the best implementation solutions.We’ll discuss what it is, the history of SCA, how it works, and why it’s important. To start, let’s define SCA. What are the SCA requirements? SCA is a set of payments industry regulatory requirements that seek to help secure online and mobile payments and reduce fraud.Utilizes unique encryption keys for authentication and digital signatures, available through Thales USB tokens and smart cards. Learn More

Strong Customer Authentication (SCA) was initiated to increase the security of electronic payments through requiring customers to provide two forms of identification when shopping online: Before SCA, payments were authorized using only .Strong Customer Authentication (SCA) is a mandate introduced by the Payment Services Directive (PSD2) enacted by the European Commission, which requires electronic payments initiated by the buyer to be authenticated by at least two of the following three factors. Something the cardholder knows (e.g., a password or PIN) Something the cardholder .

What is Strong Customer Authentication (SCA)? Strong Customer Authentication is a set of upcoming regulatory requirements, designed to make paying online more secure and, consequently, reduce payment fraud. SCA adds an extra layer of security when end-customers make a payment online.

Strong customer authentication, or SCA, is a European regulation designed to slash payment fraud rates and bolster the security of contactless and online transactions. It affects everything from Google Pay to credit card transactions to contactless at the till. SCA is tucked into the European Union’s revised Payment Services Directive (PSD2). This includes the introduction of strong customer authentication (SCA) requirements, which are now enforced throughout the EU and the UK. Below, we’ll cover strong customer authentication, the SCA requirements set out in PSD2, and what to expect from new legislation PSD3 and PSR1.

what does sca mean in credit card

what does sca mean in banking

strong customer authentication sca

gas cylinder rfid tag

\$\begingroup\$ Probably worth reading the documentation of NFC chips capable of energy harvesting to see if they give any figures. Variability is .You need a phone or mobile device with an NFC reader (an NFC-enabled mobile device) to scan your passport and upload it to Persona. See more

sca smart card|strong customer authentication guidelines