how to be smart about credit cards Stay on top of your monthly payments and avoid costly fees and interest . View scores and results from week 8 of the 2015 NFL Regular Season. View scores .

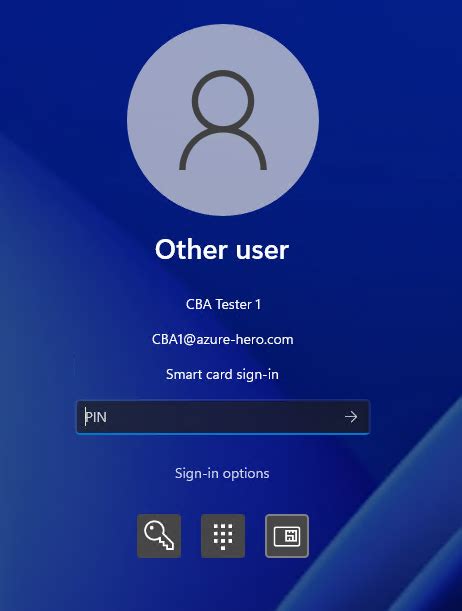

0 · smartcard login

1 · smart credit log in

2 · smart credit cards to open

3 · smart card terms and conditions

4 · smart card identity card

5 · smart card identification

6 · exxon smart card credit log

7 · credit cards with no annual fee and no interest

The NFC wild card matchups were set beforehand, with the top-seeded 49ers receiving a bye: . WILD CARD ROUND. Saturday, Jan 13. No. 4 Houston Texans 45, No. 5 Cleveland Browns 14.

Stay on top of your monthly payments and avoid costly fees and interest .

If you have a credit card, it’s crucial that you use your credit card responsibly. Here are some tips to keep in mind to ensure your credit card usage stays in check. 1. Always Try to Pay Off Your Statement Balance in Full. With average interest rates topping 24%, credit cards can be a very expensive way to borrow money. Stay on top of your monthly payments and avoid costly fees and interest charges with these smart credit card strategies.

Find out how to save thousands by being smart about your credit card use. Credit cards are a great tool. They can help you build credit and get paid for purchases you'd have made.Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full.

Not using credit could mean missing out on important credit card benefits. Instead, it's a good idea to sign up for a credit card ASAP, and follow these five cardinal rules of smart. Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if. Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor. Learning how to use a credit card responsibly can help you better manage your finances and may positively affect your credit scores. Familiarizing yourself with your credit card terms and conditions can help you understand how to keep your account in good standing.

Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards.

Here’s how to be a smart credit card user: Ask Yourself Questions. Do you need to use a credit card? Would cash or a debit card work just as well? Do you understand how interest is charged? How will fees be assessed? How are minimum payments and due dates are determined? The answer to each of these questions is different for each card. If you have a credit card, it’s crucial that you use your credit card responsibly. Here are some tips to keep in mind to ensure your credit card usage stays in check. 1. Always Try to Pay Off Your Statement Balance in Full. With average interest rates topping 24%, credit cards can be a very expensive way to borrow money. Stay on top of your monthly payments and avoid costly fees and interest charges with these smart credit card strategies.

Find out how to save thousands by being smart about your credit card use. Credit cards are a great tool. They can help you build credit and get paid for purchases you'd have made.

Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full. Not using credit could mean missing out on important credit card benefits. Instead, it's a good idea to sign up for a credit card ASAP, and follow these five cardinal rules of smart. Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if. Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor.

Learning how to use a credit card responsibly can help you better manage your finances and may positively affect your credit scores. Familiarizing yourself with your credit card terms and conditions can help you understand how to keep your account in good standing. Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards.

smart card service android para que serve

smartcard login

Seattle (11-5) couldn't quite catch the 49ers for the NFC West crown, but still nabbed a wild-card spot. Philadelphia (9-7) held off the Cowboys to win the weak NFC East. The broadcast will sound .

how to be smart about credit cards|smart card identification