current smart credit card About - Current | Future of Banking The successful integration of mobile NFC and tokenization technology has established EastWest as a pioneer, empowering Filipinos to stand alongside global giants like Apple and Google. EastWest Pay, in partnership .

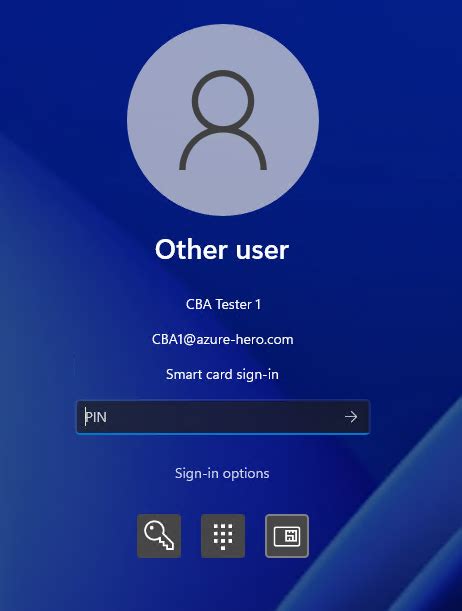

0 · smartcard login

1 · smart credit log in

2 · smart credit cards to open

3 · smart card terms and conditions

4 · smart card identity card

5 · smart card identification

6 · exxon smart card credit log

7 · credit cards with no annual fee and no interest

Rivermark Online Banking and Mobile Banking tools make it easy to take control of your money. Best of all, these tools are free, secure and convenient. . Card Control Protect yourself .How to activate or change your sim card. 1. If you’re a new customer, insert the SIM card into .

Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC.

About - Current | Future of BankingBlog - Current | Future of BankingSpend - Current | Future of Banking

Save - Current | Future of BankingInvest - Current | Future of BankingCareers - Current | Future of BankingInterest Terms of Service - Current | Future of Banking

Get your cash back directly deposited into your U.S. Bank checking or savings account, as a statement credit, a rewards card, merchant gift cards and more. 2 Pay over time with a U.S. . The U.S. Bank Smartly™ Visa Signature® Card * is a flat-rate cash-back card that earns more when you pair it with a U.S. Bank Smartly Savings Account. The card has four reward tiers ranging.Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC.

Get your cash back directly deposited into your U.S. Bank checking or savings account, as a statement credit, a rewards card, merchant gift cards and more. 2 Pay over time with a U.S. Bank ExtendPay® Plan. The U.S. Bank Smartly™ Visa Signature® Card * is a flat-rate cash-back card that earns more when you pair it with a U.S. Bank Smartly Savings Account. The card has four reward tiers ranging. You can now join the U.S. Bank Smartly™ Visa Signature® Card waitlist to earn up to 4% cash back on all purchases with no limits. Your cashback rate will ultimately depend on how much money you.NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of 2024 – from generous rewards and giant sign-up bonuses to long 0% APR periods and.

Smart cards want to replace your wallet full of debit and credit cards with one dynamic smart card. Here's what you need to know.

US Bank recently announced the US Bank Smartly Visa Signature Card, a new rewards credit card that offers up to 4% cash back on all purchases, if you have enough qualifying balances with them. This is the newest entrant to relationship banking, where banks offers you extra perks for combining multiple account types with them like savings . The card has now officially launched and is available to the public, starting with its waitlist of 350,000 people. The X1 Card, originally unveiled in 2020, promises smart technology, an unparalleled rewards program, higher limits, lower interest rates and no annual fees. Best for paying rent: Bilt Mastercard®. Best for premium perks: Capital One Venture X Rewards Credit Card. Best entertainment rewards credit card: Capital One Savor Cash Rewards Credit Card. Best.

smartcard login

Current is a mobile app that empowers people to make smart financial decisions. With a Current account, you can get a debit card or the Build Card to safely build credit, all while having access to features like earlier direct deposits, budgeting tools, crypto trading, and .Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC.

Get your cash back directly deposited into your U.S. Bank checking or savings account, as a statement credit, a rewards card, merchant gift cards and more. 2 Pay over time with a U.S. Bank ExtendPay® Plan.

The U.S. Bank Smartly™ Visa Signature® Card * is a flat-rate cash-back card that earns more when you pair it with a U.S. Bank Smartly Savings Account. The card has four reward tiers ranging. You can now join the U.S. Bank Smartly™ Visa Signature® Card waitlist to earn up to 4% cash back on all purchases with no limits. Your cashback rate will ultimately depend on how much money you.NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of 2024 – from generous rewards and giant sign-up bonuses to long 0% APR periods and.

Smart cards want to replace your wallet full of debit and credit cards with one dynamic smart card. Here's what you need to know. US Bank recently announced the US Bank Smartly Visa Signature Card, a new rewards credit card that offers up to 4% cash back on all purchases, if you have enough qualifying balances with them. This is the newest entrant to relationship banking, where banks offers you extra perks for combining multiple account types with them like savings . The card has now officially launched and is available to the public, starting with its waitlist of 350,000 people. The X1 Card, originally unveiled in 2020, promises smart technology, an unparalleled rewards program, higher limits, lower interest rates and no annual fees.

Best for paying rent: Bilt Mastercard®. Best for premium perks: Capital One Venture X Rewards Credit Card. Best entertainment rewards credit card: Capital One Savor Cash Rewards Credit Card. Best.

smart credit log in

nhs smart card training

nid smart card facility

smart credit cards to open

An amiibo card, in this case, refers to an NFC card that some person has .

current smart credit card|smart credit cards to open