is it smart to have a credit card Bottom Line. Making everyday purchases with a credit card offers a variety of benefits. Credit cards offer convenience, security and opportunities for cardholders to earn cash back and. $15.99

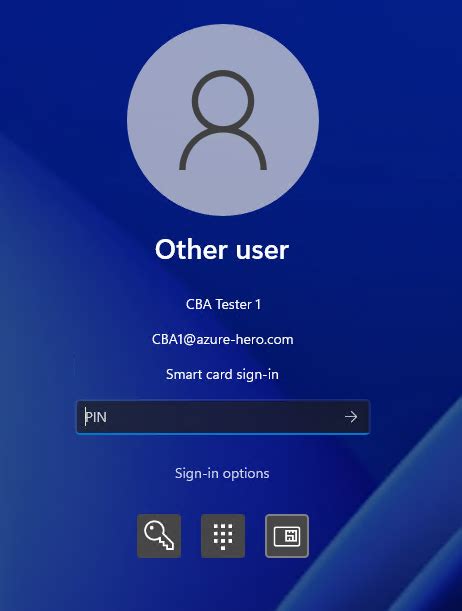

0 · smartcard login

1 · smart credit log in

2 · smart credit cards to open

3 · smart card terms and conditions

4 · smart card identity card

5 · smart card identification

6 · exxon smart card credit log

7 · credit cards with no annual fee and no interest

Place the target card on the reader and run the following command: nfc-list. This prints the UID of the target device (i.e contents of block 0 in sector 0). This is the unique ID of the chip used by the door access system .

Getting a credit card from your bank can be a great way to continue building your financial profile and credit history as well as earning valuable rewards. It can also be easier to . You have good credit: If your credit is in good standing, meaning you have a credit score of 670 or greater, you’re in a strong position to qualify for a credit card. Plus you can likely. 1. The best credit cards aren’t for beginners. As a newcomer to credit, you probably won’t be able to qualify for the absolute best credit cards — the ones with rich rewards and. Getting a credit card from your bank can be a great way to continue building your financial profile and credit history as well as earning valuable rewards. It can also be easier to qualify for a credit card from an issuer you already have a good relationship with.

Bottom Line. Making everyday purchases with a credit card offers a variety of benefits. Credit cards offer convenience, security and opportunities for cardholders to earn cash back and.

Credit cards are convenient and secure, help build credit, make budgeting easier, and earn rewards. And no, you don't have to go into debt or pay interest.

A credit card can be a good financial tool as long as you use it wisely. When should you get one, and when is it best avoided?NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of 2024 – from generous rewards and giant sign-up bonuses to long 0% APR periods and.

Research shows that younger generations are becoming more likely to avoid credit cards altogether, rather than risk mismanaging a credit card and spiraling into debt. But because credit cards offer protection, convenience and other benefits, it's usually a smart idea to open at least one account. By using a credit card every month and paying the bill by the due date, you can build a high credit score, which can help you get low rates on loans, qualify for rental homes or even jobs,. Discover the top credit cards 2024 of November, tailored to suit various needs. Explore the best options for families, budgets, and purchases to find the perfect card for your situation.

You have good credit: If your credit is in good standing, meaning you have a credit score of 670 or greater, you’re in a strong position to qualify for a credit card. Plus you can likely. 1. The best credit cards aren’t for beginners. As a newcomer to credit, you probably won’t be able to qualify for the absolute best credit cards — the ones with rich rewards and. Getting a credit card from your bank can be a great way to continue building your financial profile and credit history as well as earning valuable rewards. It can also be easier to qualify for a credit card from an issuer you already have a good relationship with. Bottom Line. Making everyday purchases with a credit card offers a variety of benefits. Credit cards offer convenience, security and opportunities for cardholders to earn cash back and.

Credit cards are convenient and secure, help build credit, make budgeting easier, and earn rewards. And no, you don't have to go into debt or pay interest. A credit card can be a good financial tool as long as you use it wisely. When should you get one, and when is it best avoided?

NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of 2024 – from generous rewards and giant sign-up bonuses to long 0% APR periods and.

Research shows that younger generations are becoming more likely to avoid credit cards altogether, rather than risk mismanaging a credit card and spiraling into debt. But because credit cards offer protection, convenience and other benefits, it's usually a smart idea to open at least one account.

By using a credit card every month and paying the bill by the due date, you can build a high credit score, which can help you get low rates on loans, qualify for rental homes or even jobs,.

rfid card holder walmart

smartcard login

rfid key fob box

rfid card scanner app

rfid credit card frequency

rfid card hack

The 2019 NFL Playoff Schedule kicked off on Saturday, Jan. 4, 2020 with two Wild-Card games. In Super Bowl LIV, the Kansas City Chiefs defeated the San Francisco 49ers 31-20 at Hard Rock Stadium .

is it smart to have a credit card|smartcard login