is it smart to get a load for credit cards Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards. Actually making them. It’s very simple. Activate NFC on your phone. Make sure .Once your return is received and inspected, we will send you an email to notify you that we have received your returned item. We will also notify you of the approval or rejection of your refund. If you are approved, then your refund will be processed, and a credit will automatically be applied to your credit card or . See more

0 · Using A Personal Loan To Pay Off Credit Card Debt

1 · Should You Take Out a Personal Loan to Pay Off Credit Card Debt?

For those seeking a simple yet secure credit card, the NatWest Credit Card offers an excellent .

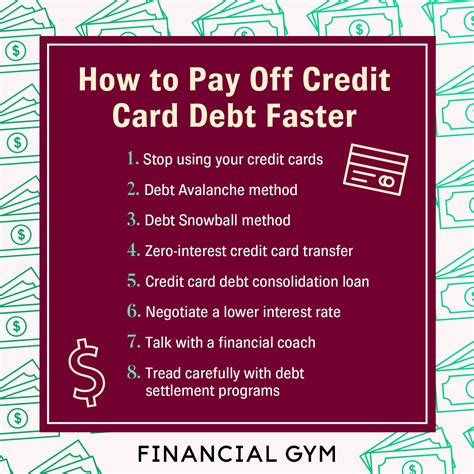

Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards. The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers . Considering a personal loan to pay off credit card debt? Some personal loans offer lower interest rates than credit cards. So consolidating your credit card debt with a personal loan may save you money on interest and potentially help you get out of debt faster. Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.

Using A Personal Loan To Pay Off Credit Card Debt

Should You Take Out a Personal Loan to Pay Off Credit Card Debt?

The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers other benefits, as well. Using a personal loan for credit card debt is a form of debt consolidation, and there are a lot of advantages to consolidating your debt into a single monthly payment. Here are three of the. Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card.

Quick Answer. If your credit card account has a steep APR and ballooning balance, it may be hard to repay with your existing income alone. You can get a personal loan to pay off your credit card, but first know the pros, cons and alternatives.

A personal loan is a debt that needs repaid. You could wind up in an even more difficult financial situation if you use a personal loan to pay off your credit cards and then continue to accumulate more credit card debt. Using a personal loan to pay off credit cards can be a smart move. But it’s crucial to consider a few things before deciding to do so. Compare the interest rates: If the personal loan. Debt consolidation is the process of paying off multiple debts with a new loan or balance transfer credit card—often at a lower interest rate. The process of consolidating debt with a personal.

rfid chip ideas

rfid chip implants 2019

Consolidation is a way to move high-interest debt onto a lower-interest product, like a balance transfer credit card or a credit card consolidation loan, which then makes it easier to pay off. Considering a personal loan to pay off credit card debt? Some personal loans offer lower interest rates than credit cards. So consolidating your credit card debt with a personal loan may save you money on interest and potentially help you get out of debt faster. Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards. The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers other benefits, as well.

Using a personal loan for credit card debt is a form of debt consolidation, and there are a lot of advantages to consolidating your debt into a single monthly payment. Here are three of the.

Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card. Quick Answer. If your credit card account has a steep APR and ballooning balance, it may be hard to repay with your existing income alone. You can get a personal loan to pay off your credit card, but first know the pros, cons and alternatives. A personal loan is a debt that needs repaid. You could wind up in an even more difficult financial situation if you use a personal loan to pay off your credit cards and then continue to accumulate more credit card debt.

Using a personal loan to pay off credit cards can be a smart move. But it’s crucial to consider a few things before deciding to do so. Compare the interest rates: If the personal loan. Debt consolidation is the process of paying off multiple debts with a new loan or balance transfer credit card—often at a lower interest rate. The process of consolidating debt with a personal.

rfid chip in notes

The LG HBS-1100 is a lightweight headphone weighing 58.1 grams, making it comfortable to wear for extended periods. With a talk time of 11 hours and a .Place the tag of the NFC card to the NFC antenna area of the device to be connected. (The location of the NFC antenna may differ .

is it smart to get a load for credit cards|Using A Personal Loan To Pay Off Credit Card Debt