smart to get loan to pay credit cards LightStream, CNBC Select’s best overall pick for personal loans, offers APRs ranging from just 6.99% - 25.49% APR with AutoPay, depending on your terms. So, your savings can be even greater. See. Of course we love print, but because we also love the web we wanted to bring those two worlds together, making paper more useful than it’s .A customer today in my shop had a NFC Smart bank card that had multiple bank cards on it .

0 · personal loans for credit cards

1 · personal loans for credit card debt

2 · personal loan to pay off credit card debt

3 · personal loan for credit card payment

4 · loans to pay off credit cards

5 · loans to pay credit card debt

6 · credit karma credit card loan

7 · borrow money to pay credit card

View scores and results from week 3 of the 2015 NFL Preseason. View scores and .

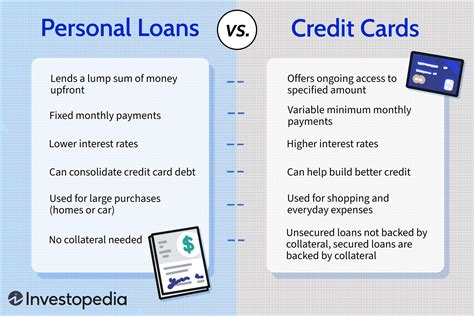

How To Get a Personal Loan To Pay Off Credit Card Debt. Using a personal loan to consolidate high-interest credit card debt is one of the most common uses for a personal loan. . How to pay off a credit card debt using a personal loan. The first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to . How To Get a Personal Loan To Pay Off Credit Card Debt. Using a personal loan to consolidate high-interest credit card debt is one of the most common uses for a personal loan. Here’s. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments

LightStream, CNBC Select’s best overall pick for personal loans, offers APRs ranging from just 6.99% - 25.49% APR with AutoPay, depending on your terms. So, your savings can be even greater. See.

Key Takeaways. Using a personal loan to pay down credit card debt comes with pros and cons. If you have good or excellent credit, a better option might be a balance transfer credit. Using a personal loan to pay off credit cards can be a savvy financial move for many people who are looking to consolidate debt. Still, it’s not the only option out there for consolidation, and it may not be right for everyone. How to pay credit card debt with a personal loan. Alternatives to manage credit card debt. Key takeaways. Using a personal loan to pay off credit card debt can save money on interest and. One way to pay off debt on multiple credit cards is to consolidate it under a new, lower interest rate loan. Find out if a personal loan can help you eliminate credit card debt.

Use a personal loan to pay off credit cards when the loan interest rate is lower than your credit card interest rate. Let's say you purchased a new roof for your home using a credit. Using a personal loan to pay off credit cards may make sense in certain situations. Here are some of the potential benefits. Lower interest rates. Personal loans tend to offer lower interest rates than credit cards. And if you have excellent or good credit, you may qualify for an even lower rate. How to pay off a credit card debt using a personal loan. The first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to . How To Get a Personal Loan To Pay Off Credit Card Debt. Using a personal loan to consolidate high-interest credit card debt is one of the most common uses for a personal loan. Here’s.

blue card rfid

Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments LightStream, CNBC Select’s best overall pick for personal loans, offers APRs ranging from just 6.99% - 25.49% APR with AutoPay, depending on your terms. So, your savings can be even greater. See. Key Takeaways. Using a personal loan to pay down credit card debt comes with pros and cons. If you have good or excellent credit, a better option might be a balance transfer credit.

Using a personal loan to pay off credit cards can be a savvy financial move for many people who are looking to consolidate debt. Still, it’s not the only option out there for consolidation, and it may not be right for everyone. How to pay credit card debt with a personal loan. Alternatives to manage credit card debt. Key takeaways. Using a personal loan to pay off credit card debt can save money on interest and. One way to pay off debt on multiple credit cards is to consolidate it under a new, lower interest rate loan. Find out if a personal loan can help you eliminate credit card debt.

Use a personal loan to pay off credit cards when the loan interest rate is lower than your credit card interest rate. Let's say you purchased a new roof for your home using a credit.

personal loans for credit cards

personal loans for credit card debt

benefits of rfid tags in shops

Simply NFC is the most powerful, simple, and accessible NFC writer/reader available. Simply tap the “Read NFC” button to start scanning for NFC tags and then place the back of your phone to the tag. It’s that simple! No external hardware required!

smart to get loan to pay credit cards|borrow money to pay credit card