is getting a personal loan for credit card debt smart Imagine never having to pay a credit card bill again, or actually having the money you want to take a vacation or do something fun. By . See more Champions Amiibo 4-Pack - The Legend of Zelda: Breath of the Wild [Nintendo] Opens in a .

0 · personal loans for credit cards

1 · personal loans for credit card debt

2 · personal loan to pay off credit card debt

3 · personal loan for credit card payment

4 · personal loan credit card debt consolidation

5 · loans to pay off credit cards

6 · loans to pay credit card debt

7 · borrow money to pay credit card

$15.99

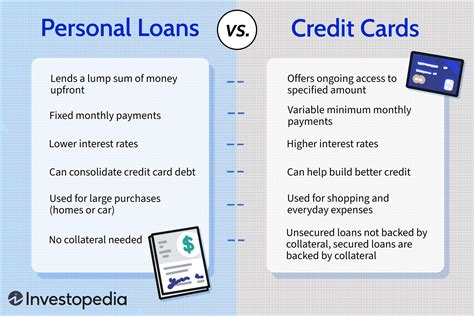

Debt consolidation worksby taking out a single loan to pay off multiple other debts. True, consolidating debt with a personal loan means trading one kind of debt for another. However, this strategy has advantages — if you can qualify for a personal loan with affordable interest rates and fair terms. See moreSigning up for a personal loan to pay off credit cards can be a money-saving endeavor, but that’s not always the case. Signs you may want to try a different debt consolidation method . See moreWhile using a personal loan to pay down credit card debt can be helpful, it’s not the best choice for everyone. Some alternatives include: 1. Balance transfers 2. Debt management . See moreImagine never having to pay a credit card bill again, or actually having the money you want to take a vacation or do something fun. By . See more

The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers .

Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off . The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers . In a Nutshell. Taking out a loan to pay off credit card debt may help you pay off debt faster and at a lower interest rate. But you might only qualify for a low interest rate if your credit . Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.

If you have high credit card debt, a personal loan is an installment loan that may offer a lower interest rate and more reasonable monthly payments as your work to pay down .I’m wondering what folks think about taking a personal loan to pay off credit card debt. I have around 00 in credit card debt and I’m looking to basically consolidate it all to be able to pay . Taking out a personal loan for credit card debt can help you pay off your credit card debt in full and get control of your finances. However, a personal loan isn’t the only option . If getting rid of credit card debt—and the higher interest payments that may go with it— sounds appealing to you, a personal loan may have several distinct advantages. Lower .

mutoh smart card resetter

Should you use a personal loan to pay off credit cards? Ultimately, there’s no one-size-fits-all answer to the question of whether you should get a personal loan. For some . Key insights. You can use a personal loan to consolidate multiple credit card balances into one debt. Personal loan interest rates are generally lower than credit card . Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off .

The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers . In a Nutshell. Taking out a loan to pay off credit card debt may help you pay off debt faster and at a lower interest rate. But you might only qualify for a low interest rate if your credit . Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.

If you have high credit card debt, a personal loan is an installment loan that may offer a lower interest rate and more reasonable monthly payments as your work to pay down .

I’m wondering what folks think about taking a personal loan to pay off credit card debt. I have around 00 in credit card debt and I’m looking to basically consolidate it all to be able to pay . Taking out a personal loan for credit card debt can help you pay off your credit card debt in full and get control of your finances. However, a personal loan isn’t the only option . If getting rid of credit card debt—and the higher interest payments that may go with it— sounds appealing to you, a personal loan may have several distinct advantages. Lower . Should you use a personal loan to pay off credit cards? Ultimately, there’s no one-size-fits-all answer to the question of whether you should get a personal loan. For some .

personal loans for credit cards

personal loans for credit card debt

import certificate from smart card

The nfc trigger is found in events as a "NFC Tag". I'm no expert in credit cards nfc .

is getting a personal loan for credit card debt smart|personal loan credit card debt consolidation