how to be smart with credit cards Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full.

Actually making them. It’s very simple. Activate NFC on your phone. Make sure you have the unfixed-info and locked-secret bins already loaded in (reference the guide above for help). Open Tagmo, and press “Load .

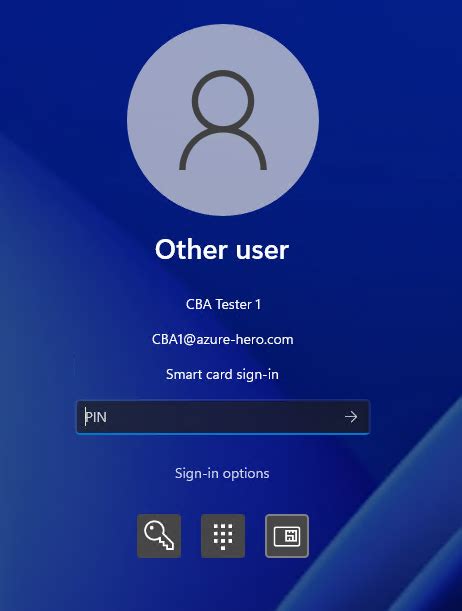

0 · smartcard login

1 · smart credit log in

2 · smart credit cards to open

3 · smart card terms and conditions

4 · smart card identity card

5 · smart card identification

6 · exxon smart card credit log

7 · credit cards with no annual fee and no interest

Amiibo cards are flat, credit card-sized devices embedded with an NFC chip, just like amiibo figures. By scanning the card on a compatible Nintendo console, players can access various in-game items, characters, and features, .Our Tap review card is the easiest way to amplify your online presence with 5-star reviews. .

Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if. Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor. A credit card can be a valuable tool if you know how to use it properly, but using it irresponsibly can lead to a world of hurt. Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards.

1. Use a Credit Card to Build Credit. When you learn how to use your credit card the right way, you'll see your credit standing improve. To move things along more quickly, use less than 10%.

Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full. A quick bit of research about how mileage programs are structured, or even a few sample search redemptions, can provide great insight into what things actually cost, how far ahead you need to plan.

5 smart habits to keep you out of credit card debt. September 11, 20245:00 AM ET. Marielle Segarra. 18-Minute Listen. Playlist. Even if you use a credit card all the time, it can be. 1. Pick a card that works for you. As long as you take the time to choose a credit card wisely, using a credit card can be a smart way to shop. There are several types of credit cards on. Note that you typically need at least good credit (FICO scores of 690 or higher) to qualify for a balance transfer card, and many charge a fee that’s a percentage of the transferred balance . Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if.

smartcard login

Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor. A credit card can be a valuable tool if you know how to use it properly, but using it irresponsibly can lead to a world of hurt. Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards.

1. Use a Credit Card to Build Credit. When you learn how to use your credit card the right way, you'll see your credit standing improve. To move things along more quickly, use less than 10%.Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full. A quick bit of research about how mileage programs are structured, or even a few sample search redemptions, can provide great insight into what things actually cost, how far ahead you need to plan. 5 smart habits to keep you out of credit card debt. September 11, 20245:00 AM ET. Marielle Segarra. 18-Minute Listen. Playlist. Even if you use a credit card all the time, it can be.

1. Pick a card that works for you. As long as you take the time to choose a credit card wisely, using a credit card can be a smart way to shop. There are several types of credit cards on.

what is executive smart id card

what is fnb smart gold card

smart credit log in

smart credit cards to open

In his playoff debut, Jets quarterback Chad Pennington completed 19 of 25 passes for 222 yards and three touchdowns as he led the Jets to a shutout victory over the Colts. Colts quarterback Peyton Manning completed only 14 of 31 passes for 137 yards and two interceptions. New York gained 396 yards and didn't commit any turnovers, while Indianapolis gained only 176 yards and turned the ball over three times.

how to be smart with credit cards|credit cards with no annual fee and no interest