smart use of credit card results in Understand that your credit score is what qualifies you for the best credit card APR and rewards, including introductory zero-APR offers. So if your credit score is not optimal, work to improve it before opening a new credit card. $24.00

0 · why use a credit card

1 · limiting credit card uses

2 · how does credit card usage work

3 · how do credit cards work

4 · credit card consumer statistics

5 · benefits of credit cards

Per usual, Week 18 of the 2023 NFL season is set to be a wild ride, as control of various seeds in both the AFC and NFC playoff races figure to change hands frequently throughout the NFL's loaded .

Understand that your credit score is what qualifies you for the best credit card APR and rewards, including introductory zero-APR offers. So if your credit score is not optimal, work to improve it before opening a new credit card.Understand that your credit score is what qualifies you for the best credit card APR and rewards, including introductory zero-APR offers. So if your credit score is not optimal, work to improve it before opening a new credit card. Not using credit could mean missing out on important credit card benefits. Instead, it's a good idea to sign up for a credit card ASAP, and follow these five cardinal rules of smart. The results show that more than a third of people (35%) primarily use credit cards to earn rewards. Other popular reasons include “a credit card is safer to carry around than cash” (33%).

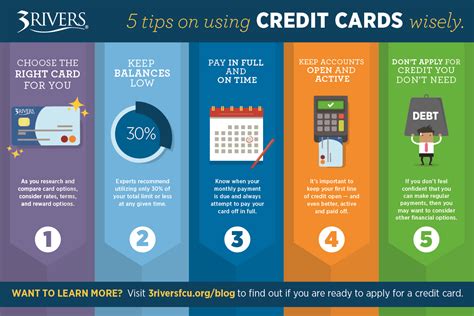

Use a credit card with these basic principles in mind: Pay bills on time, spend only what you can afford and pay off your balance in full every month.

Unlock the full potential of your credit cards with smart usage strategies. Discover how to maximize benefits, minimize risks, and safeguard your financial well-being. Trust Credlocity for expert advice on responsible credit card . Using a credit card in an emergency can lead to high-interest debt that’s tough to manage. So, save first, and reserve credit card usage for planned purchases and bills. By using credit cards mindfully, you can harness their full potential .

Top 8 Tips for Smart Credit Card Use. Final Thoughts. If you don't have methods for smart credit card use, it can be costly – Canadians have an average of ,240 in credit card debt. Credit card debt repayments was also mentioned by 28 per cent of Canadians as a top financial stressor, according to our 2021-2022 Canadians and Money Survey. What Should I Use My Credit Card For? Financial experts recommend using your credit card to build credit and take advantage of points and rewards for purchases such as the following: Appliances and electronics. Business expenses. Online purchases. Rental cars. Travel. Streaming service subscriptions. Groceries. Home repairs. Smart usage can build or improve your credit, while delivering valuable perks and benefits. Poor credit card habits, on the other hand, can be disastrous to your credit score and overall financial health. At Experian, one of our priorities is consumer credit and finance education.Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full.

why use a credit card

Understand that your credit score is what qualifies you for the best credit card APR and rewards, including introductory zero-APR offers. So if your credit score is not optimal, work to improve it before opening a new credit card. Not using credit could mean missing out on important credit card benefits. Instead, it's a good idea to sign up for a credit card ASAP, and follow these five cardinal rules of smart. The results show that more than a third of people (35%) primarily use credit cards to earn rewards. Other popular reasons include “a credit card is safer to carry around than cash” (33%).

Use a credit card with these basic principles in mind: Pay bills on time, spend only what you can afford and pay off your balance in full every month. Unlock the full potential of your credit cards with smart usage strategies. Discover how to maximize benefits, minimize risks, and safeguard your financial well-being. Trust Credlocity for expert advice on responsible credit card . Using a credit card in an emergency can lead to high-interest debt that’s tough to manage. So, save first, and reserve credit card usage for planned purchases and bills. By using credit cards mindfully, you can harness their full potential . Top 8 Tips for Smart Credit Card Use. Final Thoughts. If you don't have methods for smart credit card use, it can be costly – Canadians have an average of ,240 in credit card debt. Credit card debt repayments was also mentioned by 28 per cent of Canadians as a top financial stressor, according to our 2021-2022 Canadians and Money Survey.

What Should I Use My Credit Card For? Financial experts recommend using your credit card to build credit and take advantage of points and rewards for purchases such as the following: Appliances and electronics. Business expenses. Online purchases. Rental cars. Travel. Streaming service subscriptions. Groceries. Home repairs.

Smart usage can build or improve your credit, while delivering valuable perks and benefits. Poor credit card habits, on the other hand, can be disastrous to your credit score and overall financial health. At Experian, one of our priorities is consumer credit and finance education.

share business card via nfc

nfc business cards uk reviews

limiting credit card uses

how does credit card usage work

Gift cards; Licensing; Unlocked stories; View Sitemap; Search Search the Community. No results; Cancel. . Windows Login NFC Hi, . They have seen that Windows .

smart use of credit card results in|credit card consumer statistics