debit card vs credit card vs smart card Key Takeaways. Debit and credit cards both allow cardholders to obtain cash and make purchases. Debit cards are linked to the user's bank . There is no option to add NFC reader on a modern iPhone 15 model. It's .

0 · visa vs debit card

1 · debit cards vs credit cards

2 · debit card vs prepaid card

3 · debit card vs balance

4 · debit card vs atm card

5 · credit card vs debit card online

6 · credit card vs debit account

7 · credit card rewards vs debit

Smart NFC Tools is the most accessible and easy to use NFC Reader and Writer for mobile devices! With a simple user interface and .

If card information has been stolen and potentially fraudulent transactions have been made, two laws protect your rights. For credit cards, the primary law is the Fair Credit Billing Act, or FCBA. For debit card transactions, the Electronic Funds Transfer Act (EFTA) applies. While these laws offer some similar protections, . See moreAlthough credit cards are a safer bet for spending online, it's possible that you do not have access to one. In this case, there are still ways to protect yourself from fraud. Maintaining a . See more

From a legal perspective, credit cards generally provide more protection against fraudulent activity. But, there are ways to mimic some of these . See more

gd1720 nfc card

Key Takeaways. Smart cards contain an embedded microprocessor for secure data storage and transactions, while debit cards store information on a magnetic stripe and require a linked bank account. Smart cards offer more secure . Key Takeaways. Debit and credit cards both allow cardholders to obtain cash and make purchases. Debit cards are linked to the user's bank . A credit card offers better fraud protection and helps you build good credit, but a debit card allows you to avoid interest and debt. The main difference between debit cards and credit cards is that debit cards are linked to a checking account and funds are pulled out .

Smart cards are credit or debit cards that contain an embedded microprocessor chip. These microprocessors are able to store and process data directly. Unlike traditional magnetic stripe cards, they don’t require a remote connection.

visa vs debit card

Credit cards give you access to a line of credit issued by a bank, while debit cards deduct money directly from your bank account. Credit cards offer better consumer protections against fraud. The key difference: With a credit card, the card issuer must fight to get its money back. With a debit card, you must fight to get your money back. » MORE: How to prevent credit card.

Key Takeaways. Smart cards contain an embedded microprocessor for secure data storage and transactions, while debit cards store information on a magnetic stripe and require a linked bank account. Smart cards offer more secure transactions . Key Takeaways. Debit and credit cards both allow cardholders to obtain cash and make purchases. Debit cards are linked to the user's bank account and are limited by how much money.

A credit card offers better fraud protection and helps you build good credit, but a debit card allows you to avoid interest and debt.

The main difference between debit cards and credit cards is that debit cards are linked to a checking account and funds are pulled out immediately after a purchase, while credit cards are linked to a line of credit and purchases are paid off at a later date. A credit card is also far more likely to offer rewards.Smart cards are credit or debit cards that contain an embedded microprocessor chip. These microprocessors are able to store and process data directly. Unlike traditional magnetic stripe cards, they don’t require a remote connection.

Credit cards give you access to a line of credit issued by a bank, while debit cards deduct money directly from your bank account. Credit cards offer better consumer protections against fraud.

Knowing the key differences between a debit and credit card can help keep your finances in check. Learn the pros and cons of both in this MoneyGeek guide.Key takeaways. The main difference between a credit card and a debit card comes down to whether you’re borrowing money from a line of credit or spending money in your checking account. Credit cards can be used to build credit, while debit cards can’t. There are other differences related to interest, fees, fraud coverage and rewards. A debit card is linked to your checking account and allows you to make purchases. Debit cards work similar to cash, where you typically can't spend more money than you have in your bank.

The key difference: With a credit card, the card issuer must fight to get its money back. With a debit card, you must fight to get your money back. » MORE: How to prevent credit card.Key Takeaways. Smart cards contain an embedded microprocessor for secure data storage and transactions, while debit cards store information on a magnetic stripe and require a linked bank account. Smart cards offer more secure transactions .

do card swipes accept nfc

Key Takeaways. Debit and credit cards both allow cardholders to obtain cash and make purchases. Debit cards are linked to the user's bank account and are limited by how much money. A credit card offers better fraud protection and helps you build good credit, but a debit card allows you to avoid interest and debt. The main difference between debit cards and credit cards is that debit cards are linked to a checking account and funds are pulled out immediately after a purchase, while credit cards are linked to a line of credit and purchases are paid off at a later date. A credit card is also far more likely to offer rewards.Smart cards are credit or debit cards that contain an embedded microprocessor chip. These microprocessors are able to store and process data directly. Unlike traditional magnetic stripe cards, they don’t require a remote connection.

Credit cards give you access to a line of credit issued by a bank, while debit cards deduct money directly from your bank account. Credit cards offer better consumer protections against fraud. Knowing the key differences between a debit and credit card can help keep your finances in check. Learn the pros and cons of both in this MoneyGeek guide.

debit cards vs credit cards

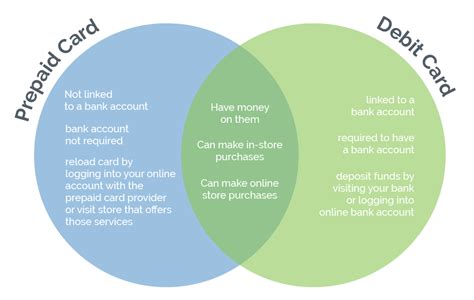

debit card vs prepaid card

Key takeaways. The main difference between a credit card and a debit card comes down to whether you’re borrowing money from a line of credit or spending money in your checking account. Credit cards can be used to build credit, while debit cards can’t. There are other differences related to interest, fees, fraud coverage and rewards.

hack nfc cards

debit card vs balance

7. InstaWifi. Use NFC Tags In the Best Possible Way. 1. NFC Tools. NFC Tools is a simple app that lets you read, write, or erase NFC tags. Once you open the app, you see 4 tabs on the top – Read, Write, Others, .

debit card vs credit card vs smart card|debit card vs balance